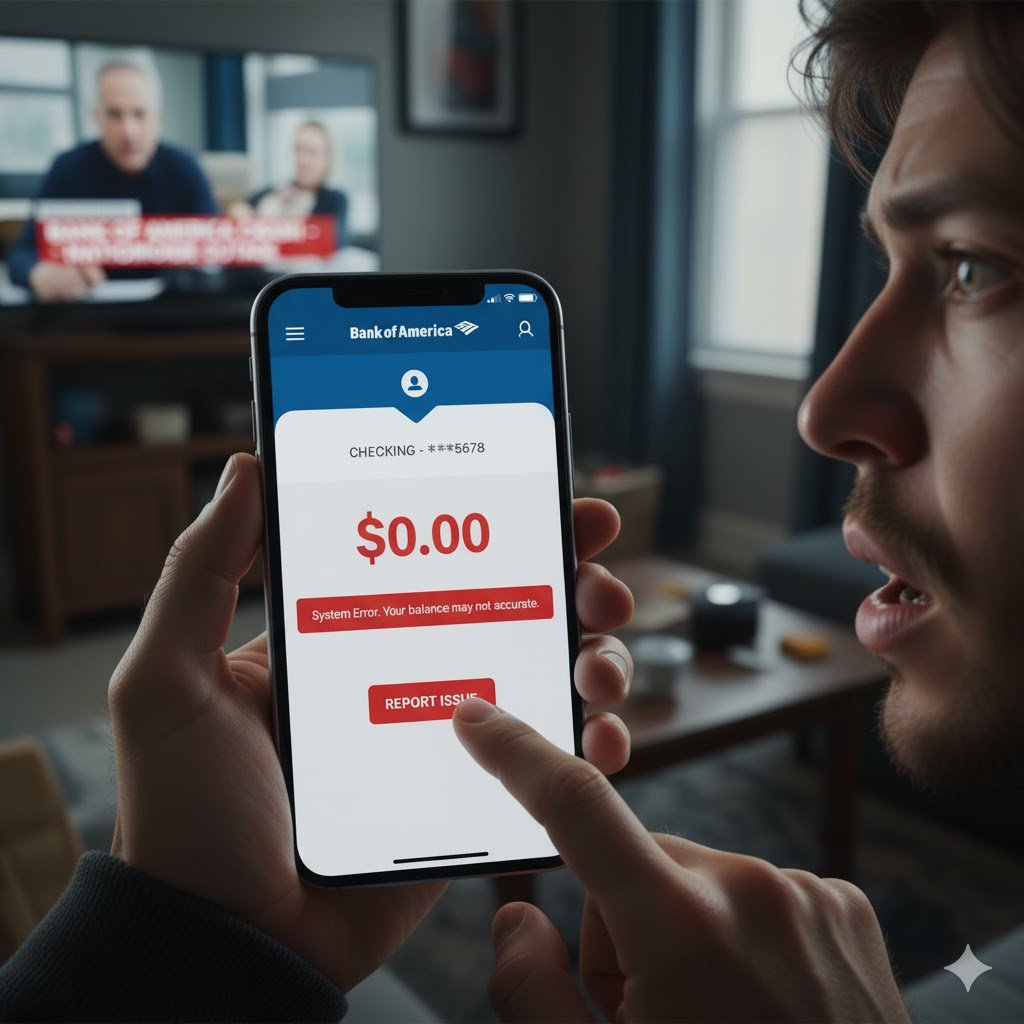

The financial confidence of thousands of Americans was severely tested on Friday, November 7, 2025, as a major technical failure hit Bank of America’s digital platforms. A widespread Bank of America outage rendered the mobile app and online banking services inaccessible for many, but the most alarming issue was a core glitch causing countless users to log in and find their BofA account showing $0 balance.

The scare prompted a flood of reports to tracking sites like downtime-detector, confirming that Bank of America was down for thousands of customers nationwide. While the bank quickly worked to contain the issue, the incident served as a stark reminder of the fragile infrastructure underpinning major modern financial institutions.

The Cause: Server Sync Error and the $0 Glitch

The root of the panic was not a security breach or a compromise of funds, but rather a catastrophic internal technical glitch during routine maintenance.

The Synchronization Failure: According to official statements released by the bank, the crash was triggered by a server synchronization error that occurred during a scheduled system update late Thursday night. This technical mishap specifically impaired the connection between the bank’s secure, core ledger system-where the actual money is held, and the front-end servers responsible for displaying customer data on the mobile app and website.

The Alarm: Because the front-end display system couldn’t retrieve the accurate balance from the ledger, it defaulted to the worst possible placeholder as $0 For many users, particularly those waiting for direct deposits or dealing with time-sensitive payments, the sight of a zero balance led to immediate fear that their savings had been wiped out.

Public Reaction: The immediate and widespread reaction drove the search query “Is Bank of America down?” to trend nationally. The sheer volume of reported problems, spiking dramatically during the start of the typical business day, confirmed the scope of th e Bank of America crash.

The Scope of the Bank of America Outage

The failure had severe operational impacts across the entire BofA digital network, frustrating users who rely on the platform for their daily financial management.

Inaccessibility: Users attempting to access online banking via desktop browsers were often met with error messages or long loading times, making transactions impossible.

Mobile App Failure: The Bank of America mobile app, a primary banking tool for millions, was either completely frozen, failed to allow login, or, most critically, displayed the terrifying $0 balance across Business Current, savings, and even investment accounts.

Geographic Impact: Reports on Downdetector showed the outage was concentrated in high-density regions across the U.S., with peak reporting coinciding with the critically important morning hours when businesses and individuals attempt to settle payments and check payroll status.

The timing, coinciding with payday for many, amplified the chaos. Customers were left unable to confirm funds for mortgage payments, utility bills, or necessary purchases, forcing many to rely on physical branches or use third-party payment systems, a significant setback for a bank that has heavily pushed digital-first banking.

Resolution, Recovery, and Next Steps

The technical team at Bank of America worked urgently to resolve the synchronisation error and restore service stability.

Service Restoration: By mid-day, the bank confirmed that the issue was contained and that systems were coming back online. The key priority was ensuring that the correct, verified balances were accurately reflected in the user interface.

Official Statement: Bank of America released an official apology via it’s communication channels, stressing that no customer funds were ever at risk. They clarified that all transactions initiated during the period of the Bank of America outage would be properly processed and recorded once the system fully stabilised.

While the crisis was technically managed, the reputation damage and the loss of trust caused by the BofA account showing $0 balance scare highlighted the severe risks financial institutions face when their core infrastructure fails to maintain flawless synchronization. For customers, the event was a stark reminder that even secure funds can feel vulnerable when digital access is severed.

bank of america outage, bank of america, bank of america down, is bank of america down, BofA account showing 0 balance? Bank of America customers across the U.S. report app and online banking outages; here’s what caused the Bank of America crash, BofA account showing 0 balance? Bank of America customers across the U.S. report app and online banking outages; here’s what caused the Bank of America crash, Bank of America Down for Thousands Friday, Downdetector Reports,

Leave a Reply